NOF Group Sustainability

Climate Action and Natural Capital (TCFD/TNFD)

Disclosure in Line with TCFD/TNFD Recommendations

Policy (our fundamental view)

Responding to climate change and conserving natural capital (biodiversity, water, etc.) are urgent, shared global challenges. Failure to address them would entail a wide range of threats including extreme weather events, food crises, and the depletion of water resources. The Paris Agreement and the Kunming-Montreal Global Biodiversity Framework both emphasize the importance of corporate action in resolving these issues.

Support for and engagement with the TCFD and TNFD recommendations

- In April 2022, the NOF Group announced its support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). We also endorsed the recommendations of the Taskforce on Natural-related Financial Disclosures (TNFD) and joined the TNFD Forum in January 2025.

- Based on both the TCFD and TNFD recommendations, the Group will work to reduce climate change- and natural capital-related risks and create opportunities for growth, as well as expand our information disclosure.

- By engaging in information disclosure according to both the TCFD and TNFD recommendations, the NOF Group will co-create new value with the power of chemistry toward the realization of a prosperous and sustainable society as stated in the NOF VISION 2030.

Policy on climate change

Policy on greenhouse gas reduction

Climate change is primarily caused by the increase in greenhouse gas emissions resulting from fossil fuel consumption. Its negative impacts are already evident in the growing frequency of natural disasters such as heavy rainfall and flooding, the depletion of food and water resources, extreme heat, and the spread of infectious diseases. This poses significant threats to our lives and ecosystems.

NOF supports the goals of the Paris Agreement to keep the rise in the global average temperature well below 2°C above pre-industrial levels (the “2°C target”), and pursuing efforts to limit the increase to 1.5°C wherever possible.

To help mitigate climate change and realize a decarbonized society, we aim to achieve carbon neutrality by 2050. As an interim target for greenhouse gas (GHG) emission reductions, we have set a goal of reducing emissions by 40% or more by fiscal 2030 compared with fiscal 2013 levels, and we are actively working to reduce GHG emissions.

Our focus goes beyond reducing our own GHG emissions to encompass our supply chain, as we contribute to climate change mitigation through raw material procurement, efficient delivery, and the provision of environmentally friendly products and services. We are determined to take action and grow with society for a sustainable future.

GHG reduction strategy

We have established and disclosed our Management Policy Regarding Responsible Care as well as CSR Procurement Policy, declaring our commitment to GHG reduction measures across the entire supply chain.

To implement these policies, we have set Responsible Care guidelines within the Group that address climate change mitigation and adaptation, biodiversity, resource recycling, research and development, and manufacturing.

At our production sites, we are promoting the shift to lower-impact energy sources for Scope 1, improving energy efficiency for both Scope 1 and Scope 2, and responding in line with each category of Scope 3. We are also working on research and development for environment-related product lines that contribute to climate change mitigation and adaptation.

For externally procured raw materials, we have established our CSR Procurement Guidelines to promote the procurement of materials with low environmental impact. To this end, we work to raise supplier awareness, participate in the Declaration of Partnership Building with suppliers to put these principles into practice, and advance sustainable procurement activities.

Furthermore, as part of the Japan Chemical Industry Association’s Responsible Care initiatives, we actively participate in dialogue with suppliers and local communities.

Moreover, we are pursuing decarbonization innovations throughout the supply chain. This includes industry-academia collaborative projects focused on the research and development of biomass-derived materials and the effective utilization of unused exhaust heat.

Through these initiatives, we are reducing GHG emissions under Scope 3 and enhancing the overall sustainability of our entire supply chain.

Activities through industry associations

With an eye to achieving carbon neutrality by 2050 and driving social transformation, NOF is taking on the challenge of green transformation (GX) and has joined the “GX League,” in which companies pursuing sustainable growth in present and future society collaborate with corporations, government, and academia engaging in similar initiatives. In addition, we are members of many industry associations, including the Japan Chemical Industry Association (JCIA), where our President and Chief Executive Officer serves as a director. We actively incorporate and leverage in our daily activities the policies and latest developments discussed in these associations regarding climate change solutions. In addition, while working on the goals of each association, we ensure alignment so that these goals are consistent with NOF’s own policies and strategies.

Furthermore, in the Japan Soap and Detergent Association (JSDA), of which we are also a member, our President and Chief Executive Officer serves as a director and periodically assumes the role of chair of the Environmental Committee, striving to address industry-wide environmental issues.

Policy on natural capital

NOF’s initiatives to protect natural capital

The NOF Group places great importance on actively protecting and restoring natural capital. To this end, we have formulated the following policies.

- In order to minimize the impact of our business activities on natural capital, we conduct environmental impact assessments, identify risks, and implement countermeasures.

- We require our employees to comply with international guidelines, laws, and regulations related to natural capital and to work for environmental conservation.

- We assess supply chain risks that may cause natural capital loss and promote sustainable procurement through cooperation with our suppliers.

- We provide educational programs to raise environmental awareness and educate employees and relevant people on the importance of natural capital preservation.

- We cooperate with local communities in participating in local ecosystem protection activities and various projects for restoring natural capital.

Through these initiatives, we will contribute to safeguarding natural capital and help realize a more sustainable future.

General requirements under the TNFD Recommendations

- Application of materiality:

In assessing risks and opportunities for this disclosure, the NOF Group adopted a single materiality approach, ensuring alignment with our risk management practices and TCFD disclosures. - Scope of disclosure:

Please see “Scoping: Defining the Scope of Analysis” in “Strategy”. - Geographic areas with natural capital-related issues:

As areas with natural capital-related issues, we identified and analyzed all NOF Group production sites, as well as raw material production areas and procurement sites, corresponding to (2) “Scope of disclosure”. For details of the analysis results, see “Strategy”. - Integration with other sustainability-related disclosures:

We provide integrated disclosure regarding both climate change measures and the conservation of natural capital. - Time periods considered:

For the assessment of risks and opportunities, we set short-term (2023–2025), medium-term (around 2030), and long-term (around 2050) time horizons. - Engagement with Indigenous peoples, local communities, and affected stakeholders:

Please see “Oversight of Stakeholder Engagevment” in “Governance”.

Governance

Governance system for climate change response and

natural capital conservation

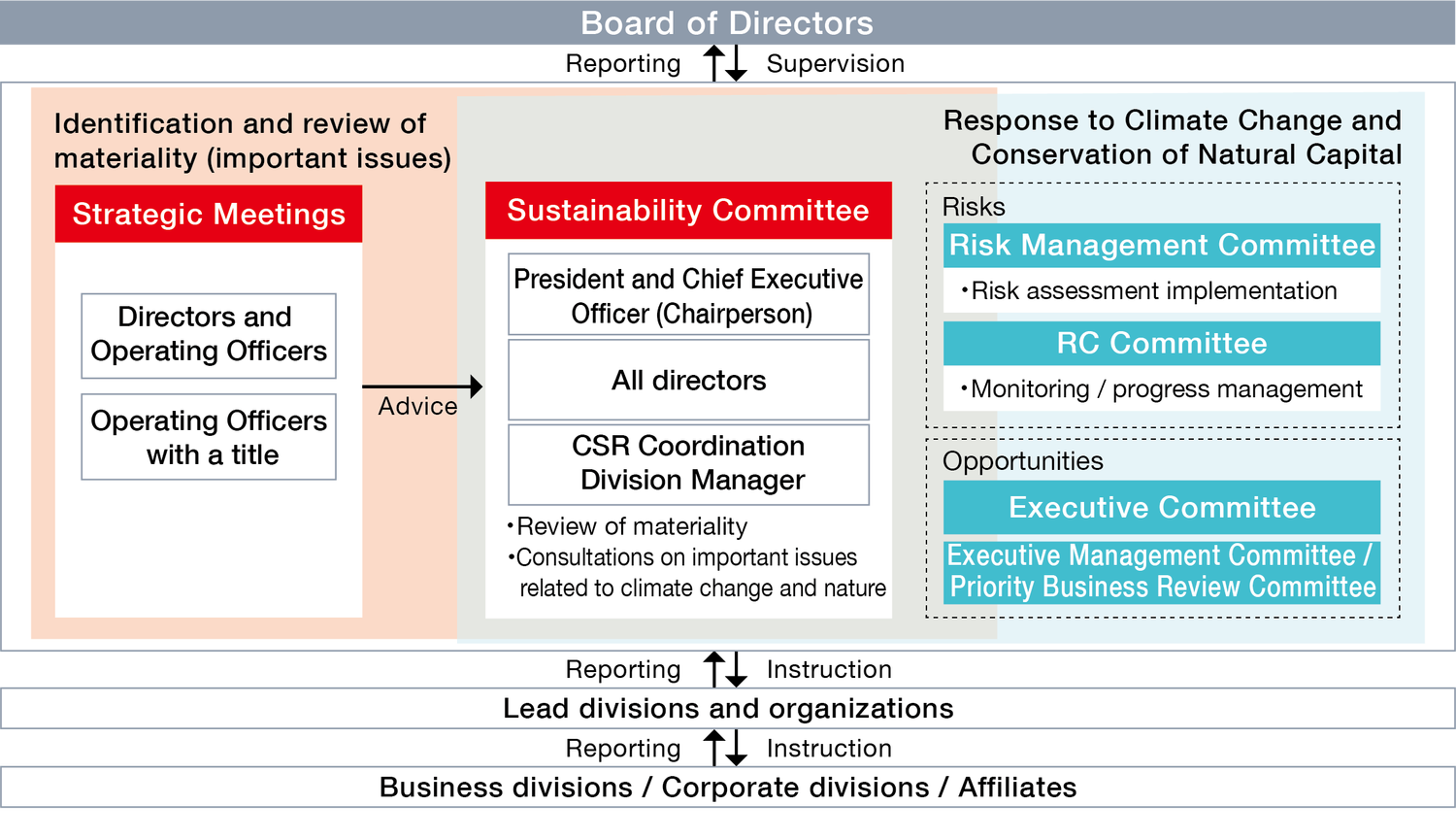

The NOF Group identifies materiality issues (important issues) related to sustainability through deliberations in the Strategic Meeting, which is composed of Directors concurrently serving as Operating Officers and Operating Officers with a title, and the Sustainability Committee, which is chaired by the President and Chief Executive Officer and all Directors participate. The Board of Directors then approves the materiality issues. As the secretariat of the Sustainability Committee, the Corporate Planning & Strategy Department, Corporate Technical Division, Human Resources & General Affairs Department, Purchasing Department, and Corporate Communications Department promote the formulation and specific development of sustainability strategies for the entire Group. The Committee also reviews materiality annually, reassessing materiality items, KPIs, numerical targets, and response policies to ensure continuous improvement in activity levels.

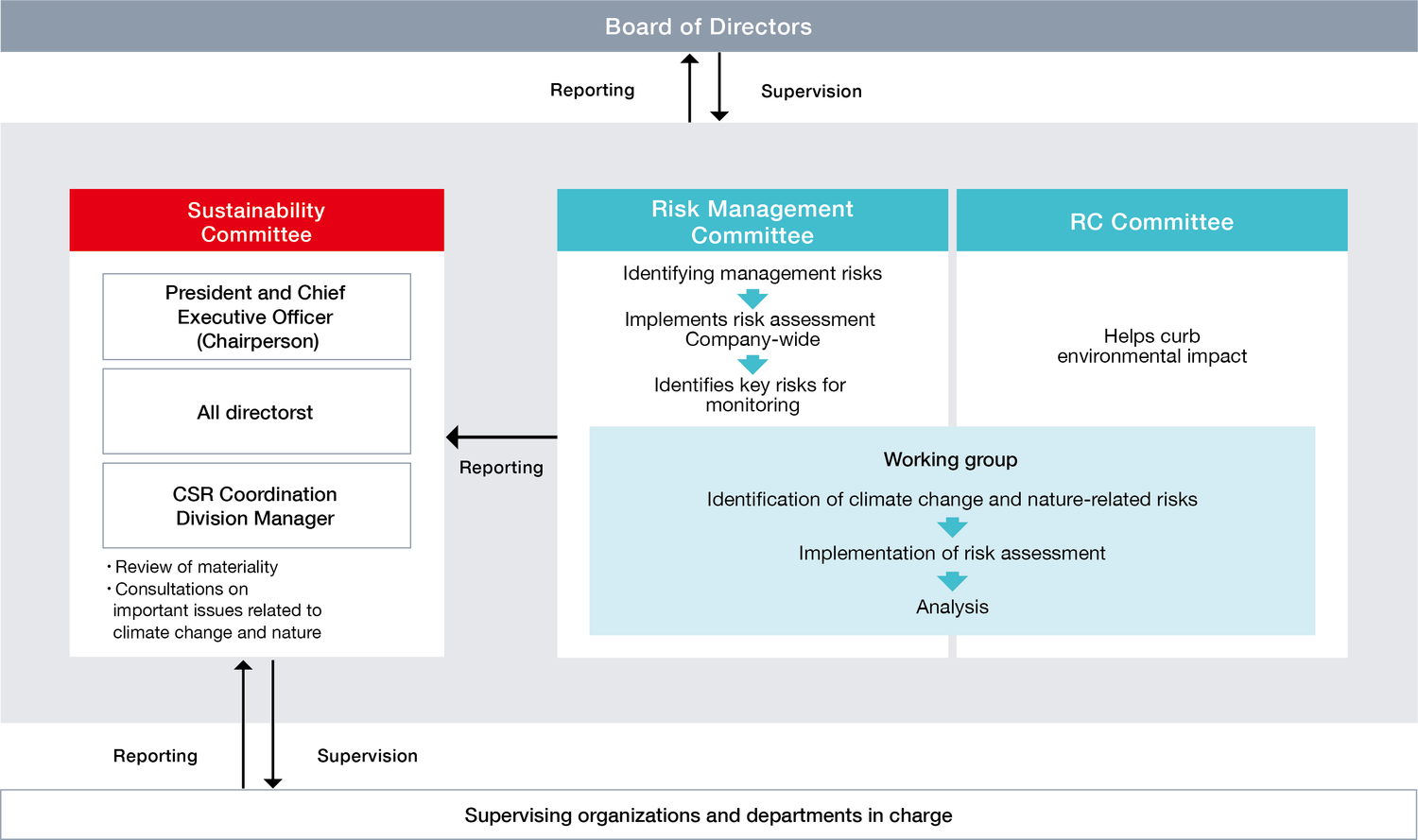

Responses to climate change and natural capital conservation are treated as important matters, including mid- to long-term goals, and are deliberated by the Sustainability Committee. In regard to risks, the Risk Management Committee conducts a comprehensive assessment, while the RC Committee supervises monitoring and managing the progress of risk countermeasures and reduction measures related to greenhouse gas emissions, pollutants emissions, and zero emissions. In addition, opportunities are discussed by the Executive Management Committee and the Priority Business Review Committee, and important matters are deliberated by the Executive Committee. Within the governance system, these committees operate under the oversight of the Board of Directors. Their deliberation results are reported to the Board. In addition to regular reports once or twice a year, a system has been put in place in which the consultation content of committees and meetings held on an ad hoc basis are reported to the Board of Directors as necessary for supervision and approval.

Governance system diagram for climate change response and natural capital conservation

Oversight of stakeholder engagement

We believe that stakeholder engagement is essential to ensure the long-term growth and the sustainability of a company. Because the business activities of the NOF Group may have impacts on Indigenous peoples, local communities, and others, we have established our CSR Procurement Policy and CSR Procurement Guidelines, and engage in dialogue with local communities. Our stakeholder engagement initiatives are discussed and supervised under the aforementioned governance system.

Strategy

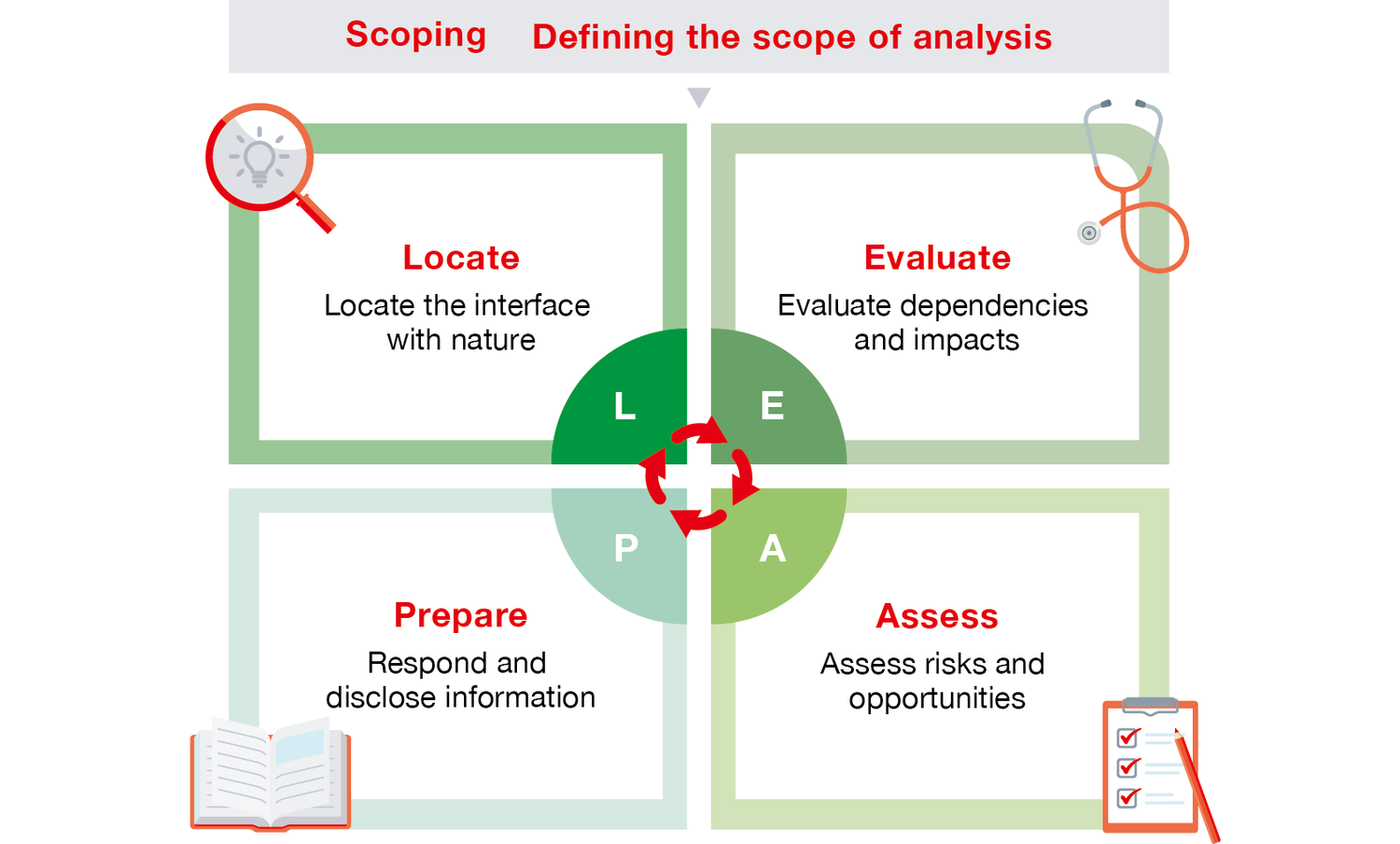

The TNFD has developed the LEAP Approach as an integrated framework for assessing nature-related issues and recommends its use to companies. The NOF Group has advanced its assessment of natural capital-related issues based on this approach.

Analysis using the LEAP approach

The LEAP approach is a process for systematic, science-based assessment of nature-related risks and opportunities. “LEAP” is an acronym for Locate (locate priority regions, i.e., regions with significant impacts on nature), Evaluate (identify and evaluate dependencies and impacts on nature), Assess (identify and assess nature-related risks and opportunities), and Prepare (prepare for disclosure). In addition, the approach begins with Scoping, involving defining the scope of the analysis.

In recent years, the loss of natural capital, including biodiversity, has gained attention as a new global risk. The NOF Group uses naturally-derived raw materials such as palm oil. For this reason, we have recognized the loss of natural capital as a significant risk, formulated policies for natural capital conservation, and actively pursued related initiatives.

Since fiscal 2023, in line with the LEAP approach recommended by the TNFD, we have conducted activities to locate the interface (priority regions) with natural capital, identify and evaluate dependencies and impacts, and identify and assess risks and opportunities.

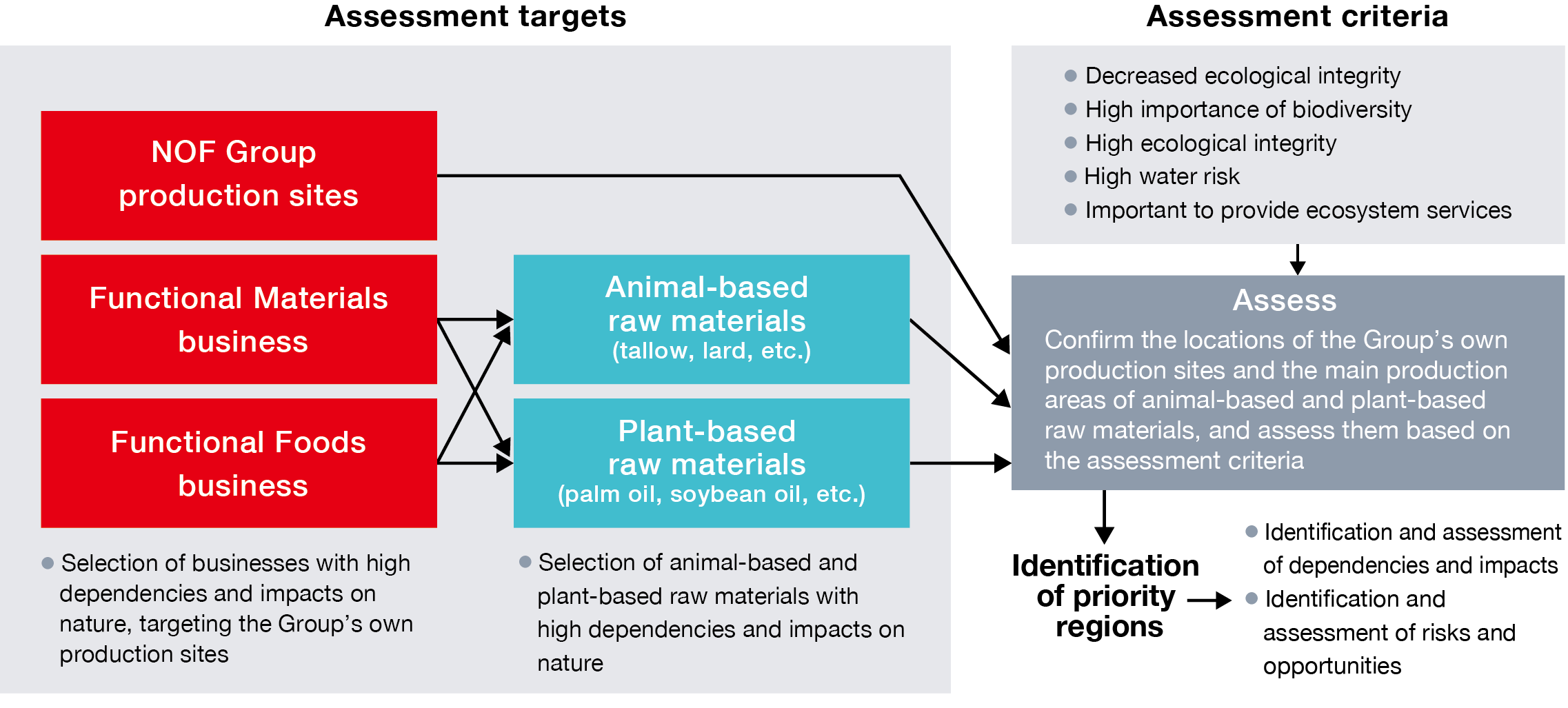

Scoping Defining the scope of analysis

The NOF Group set the scope of analysis regarding its relationship with natural capital as targeting “all production sites of the NOF Group,” and for upstream value chain analysis, the “production areas of plant-based and animal-based raw materials” used in the Functional Materials Business and Functional Foods Business, taking into account business scale as well as the level of dependency and impact on natural capital.

Locate Locate the interface with natural capital (identify priority regions*)

For both “all production sites of the NOF Group,” where NOF Group companies are directly engaged in operations, and “production areas of animal-based and plant-based raw materials” in the upstream value chain, we identified interfaces with natural capital based on location information (if detailed location data was unavailable, we estimated the location using available information).

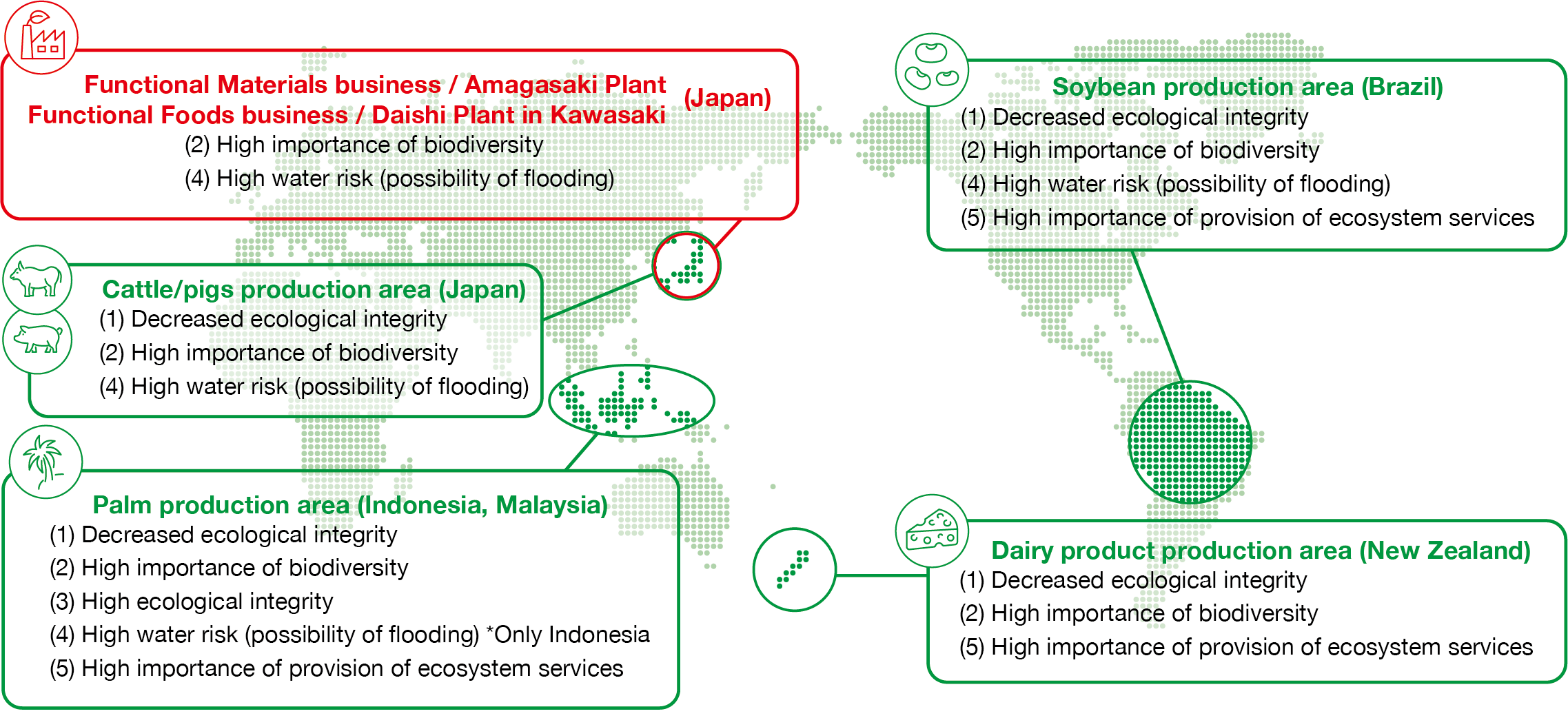

Specifically, we confirmed whether each production site and raw material production area qualified as a priority region by comprehensively considering both the perspective of impacts on natural capital (see the table below) and the perspective of impacts on our business (production volume and procurement value). The results are shown in the figure to the right. As for production sites, the NOF Group’s priority region was identified as Japan, where animal- and plant-based raw materials are used. Specifically, we identified the Amagasaki Plant of the Functional Materials Business, and the Daishi Plant in the Kawasaki Works of the Functional Foods Business. As for raw material production areas designated as priority regions, we identified Indonesia and Malaysia (palm cultivation), Japan (cattle and pigs production), Brazil (soy cultivation), and New Zealand (dairy production). Among these raw materials, we recognized pigs, palm, soy, and dairy products as the highest-priority food raw materials.

Impact on natural capital

| Impact on natural capital | Explanation |

|---|---|

| (1) Decreased ecological integrity *1 | Regions where ecosystem balance is disrupted, or healthy conditions are impaired (e.g., regions where forests are being cleared, wetlands reclaimed, or rivers polluted) |

| (2) High importance of biodiversity *1,2 |

Regions of very high importance for biodiversity (diversity of various animals, plants, and microorganisms) (e.g., habitats for many endangered species, or regions essential for the survival of plants and animals) |

| (3) High ecological integrity *1 | Regions with very rich ecosystems that remain largely intact (e.g., regions with untouched forests or unpolluted rivers) |

| (4) High water risk *3,4 | Regions with water shortages (drought risk), regions prone to flooding or water-related damage, or regions with polluted water |

| (5) High importance of provision of ecosystem services *5 |

Regions where the provision of “ecosystem services” to Indigenous peoples or local communities is important Ecosystem services: Services that benefit from natural capital, such as provisioning services (food, water, timber, fuel, etc.) and regulating services (climate regulation, water purification, flood/drought mitigation, etc.) |

The NOF Group’s priority regions

(Click to enlarge)

The level of impact on natural capital in (1)–(5) on the right was assessed using natural capital impact assessment tools recommended by the TNFD, which are listed in notes 1–5 below.

- WWF Biodiversity Risk Filter

- Key Biodiversity Areas

- WWF Water Risk Filter

- WRI Aqueduct 4.0

- Global Forest Watch map, SIGWATCH

Evaluate Evaluate dependencies and impacts

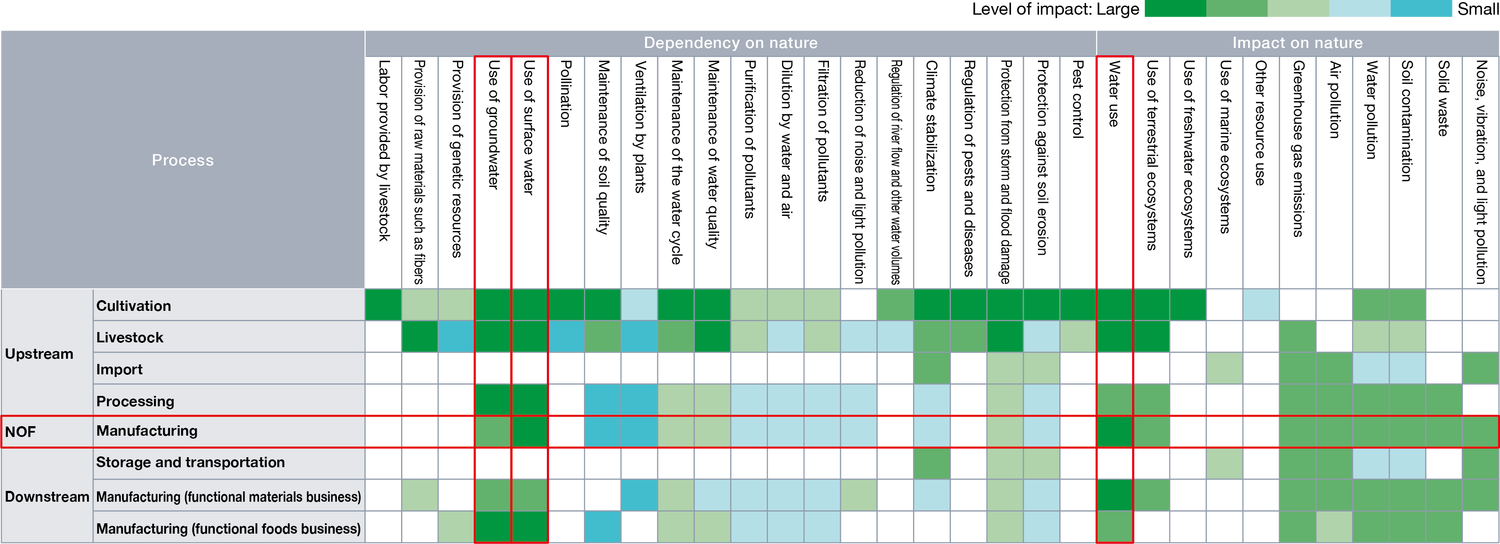

For the Functional Materials business and Functional Foods Business at the Amagasaki Plant and the Kawasaki Works (Daishi Plant), which use animal and plant-based raw materials identified as targets through the aforementioned Scoping and Locate steps, we used the ENCORE*1 tool to identify and evaluate their dependencies*2 and impacts*3 on natural capital. Specifically, we identified and evaluated dependencies and impacts on natural capital of both businesses across the value chain, including upstream (cultivation, livestock, import, and processing of raw materials), our own operations (manufacturing), and downstream (storage and transportation of products, as well as customers’ manufacturing that uses our plant products as raw materials). The results were summarized in a heat map.

The evaluation showed that with respect to dependencies on natural capital, multiple processes of the value chain share a high dependency on water (groundwater and surface water). In addition, plant cultivation and livestock farming (cattle and pigs) showed many dependency items and generally higher levels of dependency.

Meanwhile, with respect to impacts on natural capital, water usage was also identified as having a high impact across the entire value chain, similar to the dependency findings. Even within our own manufacturing operations, we recognize water use as a particularly high-impact factor, and we will continue our efforts to reduce water consumption and maintain water quality.

Relationship of value chain to dependencies and impacts on natural capital

- ENCORE: Exploring Natural Capital Opportunities, Risks and Exposure.

A tool developed by organizations such as the Natural Capital Finance Alliance (NCFA), a financial-sector network, to help financial institutions understand the degree to which companies depend on and impact natural capital. - Dependency: Ecosystem services on which business activities rely

(e.g., crop cultivation depends on ecosystem services such as water supply and pollination by insects) - Impact: Positive or negative effects of business activities on natural capital

(e.g., chemical manufacturing impacts natural capital through water use and greenhouse gas emissions.)

Assess Assess risks and opportunities

Based on the aforementioned priority regions and the results of the dependency and impact analysis, the NOF Group identified and assessed our risks and opportunities in accordance with climate change scenarios (the 1.5°C/2°C scenarios and 4°C scenario). For the assessment, the level of impact and the timeline were defined as shown below. Transition risks were assessed under the temperature representing the worst case scenario. NOF is focusing on promoting proactive consideration for the environment and developing products that contribute to environmental conservation. In responding to decarbonization markets such as electric vehicles and renewable energy, there may be risks of reduced sales in existing business areas or reputational impacts from the use of certain raw materials. However, we expect the following opportunities in the long term.

- Increased sales: As consumer awareness of environmental conservation grows, demand for products that contribute to environmental conservation will rise, driving sales growth

- Enhanced reputation: Proactive measures for climate change and emissions management, as well as the development of products that contribute to environmental conservation, will improve the Company’s reputation and credibility over the long term, also leading to higher stock value.

Transition risks(1.5° Cand 2°C scenarios)

| Cause | Value chain | Major risks and opportunities | Overview | Level of impact | Countermeasures | ||

|---|---|---|---|---|---|---|---|

| 2023–2025 | 2030 | 2050 | |||||

| Policies and regulations | Manufacturing (NOF) |

Increased manufacturing costs and decreased product sales due to environmental regulations (carbon tax, plastic tax, etc.) |

|

ー | Large | Large |

|

| Manufacturing (NOF) |

Compensation for damages due to environmental litigation, decline in sales due to plant shutdowns, and a drop in stock prices |

|

ー | Medium | Medium |

|

|

| Policies and regulations / Sharp rise in raw material and fuel prices |

Cultivation and livestock (Upstream) |

Higher procurement costs because of increased cultivation and production costs due to environmental regulations (regulations on methane emissions, wastewater, etc.) |

|

ー | Medium | Medium |

|

| Processing (Upstream) |

Higher procurement costs and production interruption-caused reduced sales due to environmental regulations (beverage container tax, packaging tax, etc.) |

|

ー | Small | Small |

|

|

| Import (Upstream) |

Higher distribution costs due to environmental regulations (SOx regulations, etc.) |

|

ー | Small | Small |

|

|

| Sharp rise in raw material and fuel prices | Cultivation and livestock (Upstream) |

Increased procurement costs due to soaring raw material prices |

|

ー | Large | Large |

|

| Import (Upst-ream) / Manufa-cturing (NOF) |

Higher energy and transportation costs due to soaring crude oil and natural gas prices |

|

ー | Medium | Medium |

|

|

| Evaluation and reputation from stakeholders |

Cultivation and livestock (Upstream) |

Reputational damage and falling stock prices due to the use of certain raw materials |

|

Large | Large | Large |

|

| (NOF) | Decline in evaluation and reputation due to delays in ESG investment |

|

ー | Small | Small |

|

|

| Market | Products (Downstream) |

Changes in the sales destination environment due to the shift to a decarbonization market |

|

ー | Medium | Medium |

|

Physical risks(4°C scenario)

| Cause | Value chain | Major risks and opportunities | Overview | Level of impact | Countermeasures | ||

|---|---|---|---|---|---|---|---|

| 2023–2025 | 2030 | 2050 | |||||

| Extreme weather |

Cultivation, livestock, processing (Upstream) |

Increase in cultivation/ production and procurement costs due to degradation of ecosystem services |

|

Large | Large | Large |

|

| Import (Upstream)/ Manufacturing (NOF) |

Decrease in sales caused by damage to production sites and supply chains from storm and flood damagec |

|

ー | Large | Large |

|

|

| Manufacturing (NOF) |

Increase in equipment costs and decline in sales due to production interruptions associated with degradation of ecosystem services |

|

ー | Small | Small |

|

|

| (NOF) | Increase in storage costs due to high temperatures and heatwaves |

|

ー | Medium | Medium |

|

|

Opportunities

| Cause | Value chain | Major risks and opportunities | Overview | Level of impact | Countermeasures | ||

|---|---|---|---|---|---|---|---|

| 2023–2025 | 2030 | 2050 | |||||

| Resource efficiency |

Manufacturing (NOF) |

Decrease in manufacturing costs through improved resource efficiency |

|

ー | Medium | Large |

|

| Capital flow / financing | (NOF) | Diversification of financing methods |

|

ー | Small | Small |

|

| Reputation | (NOF) | Improved evaluations and reputation, leading to higher stock prices |

|

ー | Medium | Medium |

|

| Market | Products (Downstream) |

Increase in sales due to growing demand for products that contribute to environmental conservation |

|

ー | Large | Large |

|

- 1.5°C and 2°C scenarios: Decarbonization scenarios that assume that necessary measures will be implemented to limit the temperature increase to 1.5°C or 2°C or less compared to pre-industrial times (International Energy Agency (IEA) “Net Zero Emissions by 2050” (NZE2050), “Stated Policies Scenario” (STEPS), etc.)

- 4°C scenario: Decarbonization scenario that assumes that necessary measures will be implemented to limit the temperature increase to 4°C or less compared to pre-industrial times (International Energy Agency (IEA) “Net Zero Emissions by 2050” (NZE2050), “Stated Policies Scenario” (STEPS), etc.)

- Level of impact: [Risks] Impact amount: Over ¥1 billion (high), ¥100 million–¥1 billion (medium), under ¥100 million (low)

[Opportunities] Impact amount: Over ¥1 billion (high), ¥100 million–¥1 billion (medium), under ¥100 million (low)

[Opportunities] Market size: Over ¥30 billion (high), ¥3 billion–¥30 billion (medium), under ¥3 billion (low)

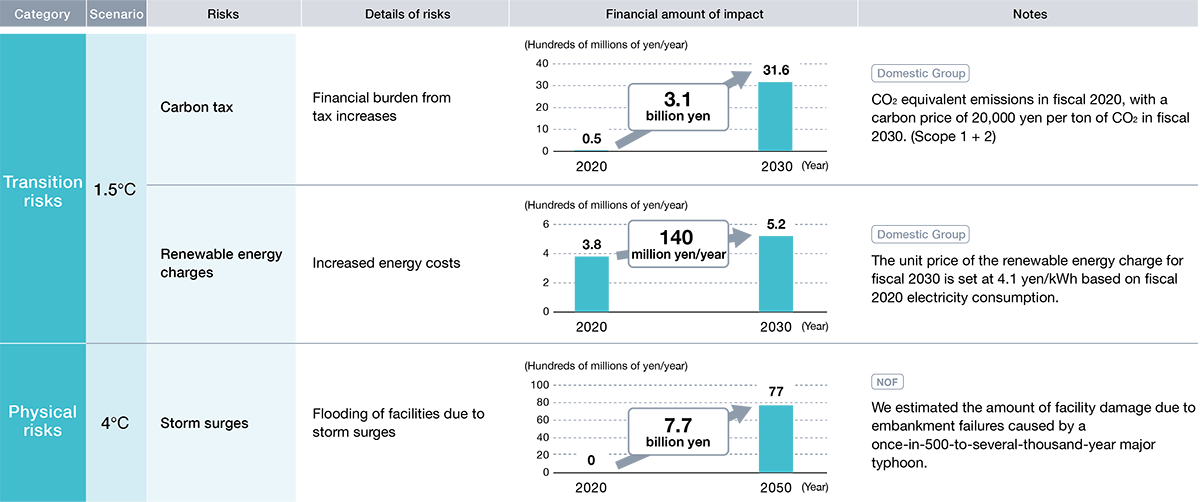

Financial impacts (selected)

Steam, electricity, and other forms of energy are consumed mainly in the manufacturing processes of the NOF Group. As transition risks brought about by climate change, the financial burden is expected to increase due to rising carbon tax costs and higher unit prices of renewable energy charges,* and the total impact is estimated to be around 3.3 billion yen. In addition, the NOF Group has established a business continuity plan for physical risks with the 4°C scenario assuming 7.7 billion yen in facilities damage in the event that a major typhoon, which occurs once every 500 to several thousand years, breaks through embankments and floods our waterfront plants.

Products that Contribute to the Environment

Within the NOF Group, we are creating a variety of products that contribute to the environment while advancing research and development of technologies that address climate change, biodiversity, resource saving and recycling, and alternatives for hazardous or legally regulated substances. The market scale for these products is as shown below, and we view this as a business opportunity for the future.

Products that contribute to the environment in relation to climate change: Mitigation (1.5°C and 2°C scenarios) *

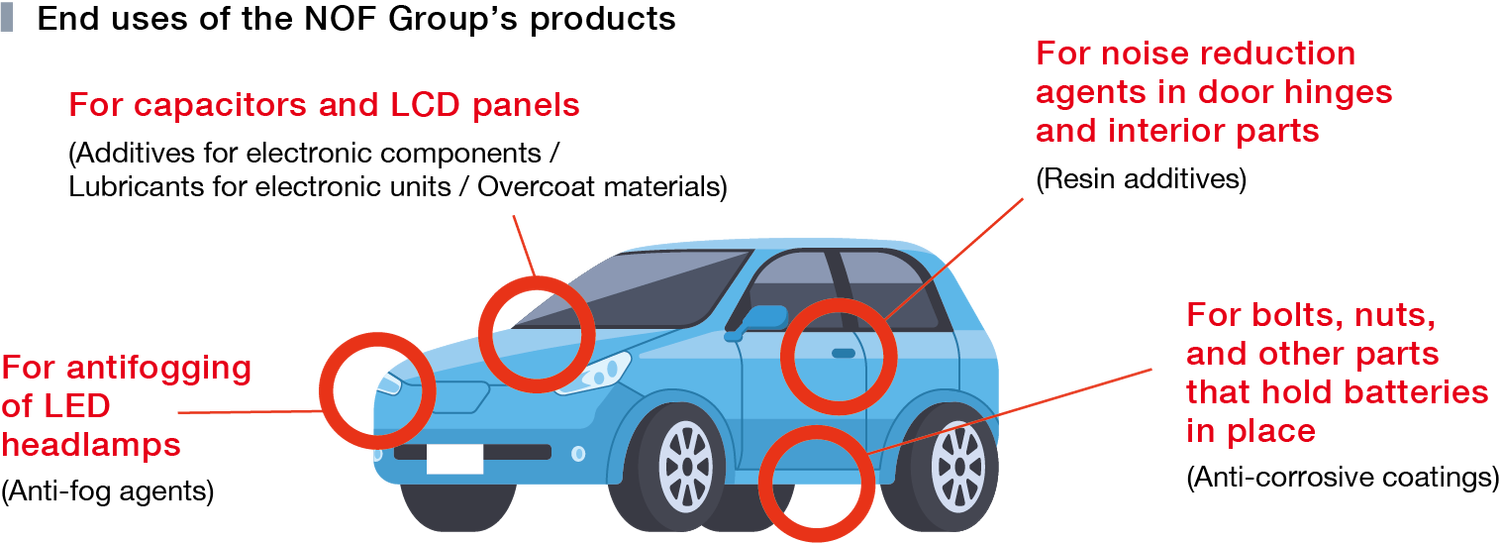

Electric vehicles

【Functional Materials business/Metal Coatings business】Market scale:Large

Compared to gasoline-powered vehicles, EVs are expected to cause increased demand for additives for in-vehicle electronic components, lubricants for electronic units, anti-corrosion coatings, and overcoat materials for LCD color filters due to the increase in electronic components (passive components) and electronic units, as well as more and larger LCD panels. In addition, because LED lights are effective in reducing power consumption of EVs, demand for anti-fog agents for LED headlamps is expected to increase. Furthermore, EVs will make vehicles quieter, which is expected to increase demand for resin additives, such as agents that prevent abnormal noises caused by resins rubbing against each other in interior parts.

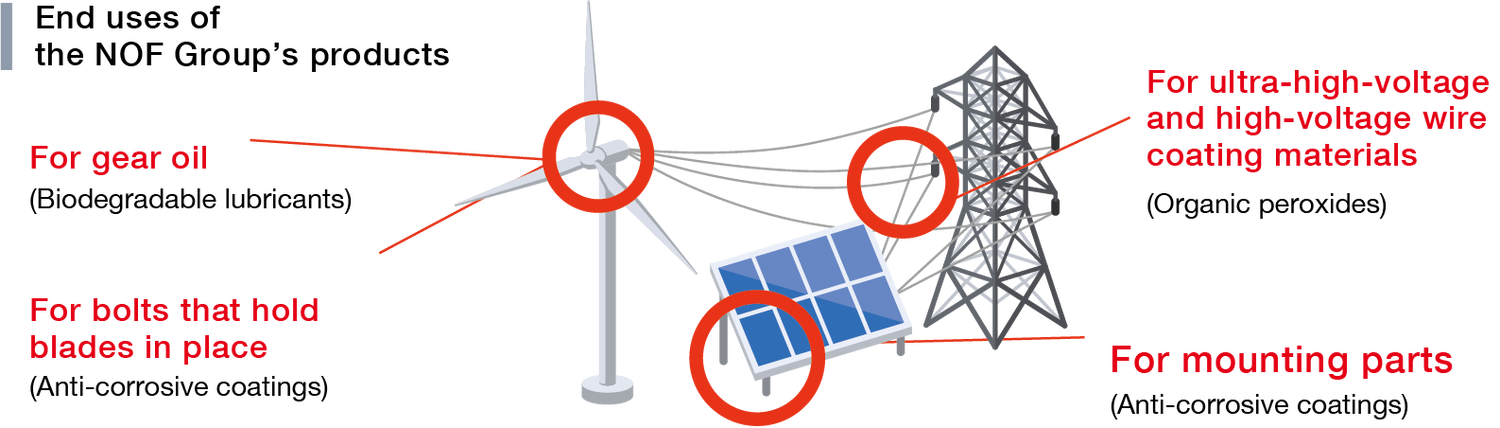

Wind / solar power generation

【Functional Materials business/Metal Coatings business】Market scale:Medium

Demand is expected to increase for anti-corrosion coatings for bolts used in wind power generation blades and solar panel mounting parts, as well as biodegradable lubricant required for gear lubrication. Demand is also expected to increase for organic peroxides for cross-linked polyethylene, which is used as a coating material for ultra-high-voltage and high-voltage electric wires used to transmit electricity from wind and solar power generation sites.

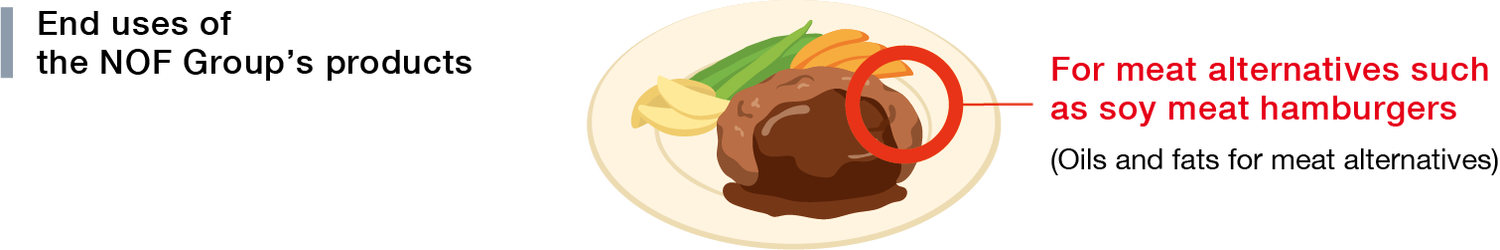

Meat alternatives

【Functional Foods business】Market scale:Small

Demand is expected to increase for meat alternative oils and fats that help improve the flavor and texture of plant-derived meat alternatives that reduce environmental impact.

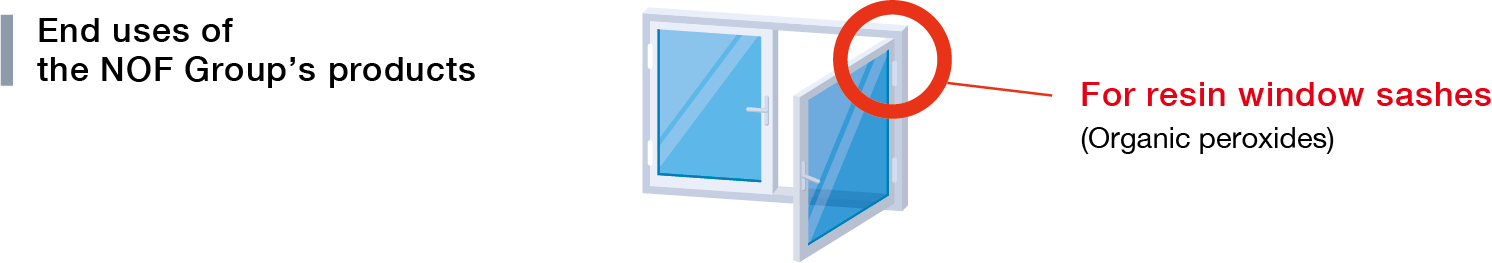

Resin window sashes

【Functional Materials business】Market scale:Small

Demand for organic peroxides is expected to increase with the spread of energy-efficient housing because vinyl chloride resin is used in resin window sashes with high thermal insulation properties.

Products that contribute to the environment related to climate change: Adaptation *

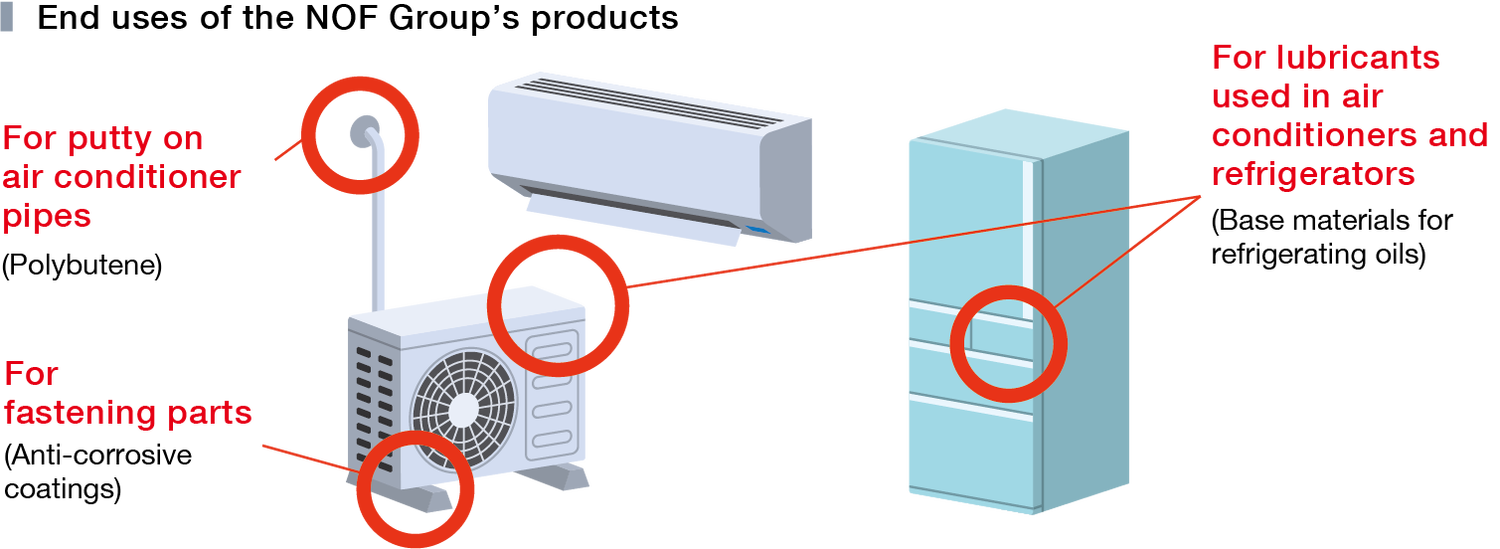

Air conditioners / refrigerators

【Functional Materials business/Metal Coatings business】Market scale:Large

Demand for refrigerating machine oil, a lubricant for refrigeration equipment, anti-corrosion coatings for fastening parts for external air conditioner units, and polybutene for air conditioner putty is expected to increase due to the increasing need for air conditioners and refrigerators accompanying rising temperatures around the world, including developing countries. The base materials for refrigerating oils sold by NOF are for alternative CFC refrigerants and contribute to climate change adaptation.

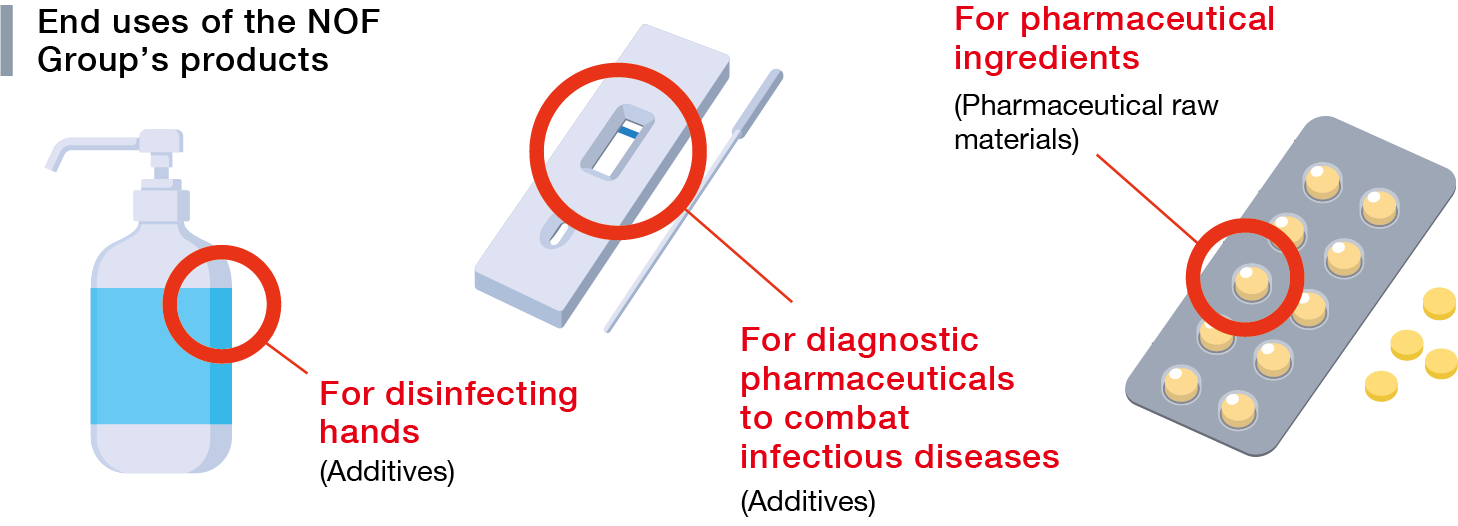

Diagnostic pharmaceuticals / Pharmaceutical raw materials

【Functional Materials business/Life Science business】Market scale:Large

Due to climate change, there are concerns about the spread of tropical infectious diseases and other diseases and disorders. Therefore, demand for pharmaceutical raw materials is expected to increase due to the rise in disinfectants and additives for diagnostic pharmaceuticals to combat infectious diseases as well as the number of pharmaceutical products against diseases and disorders.

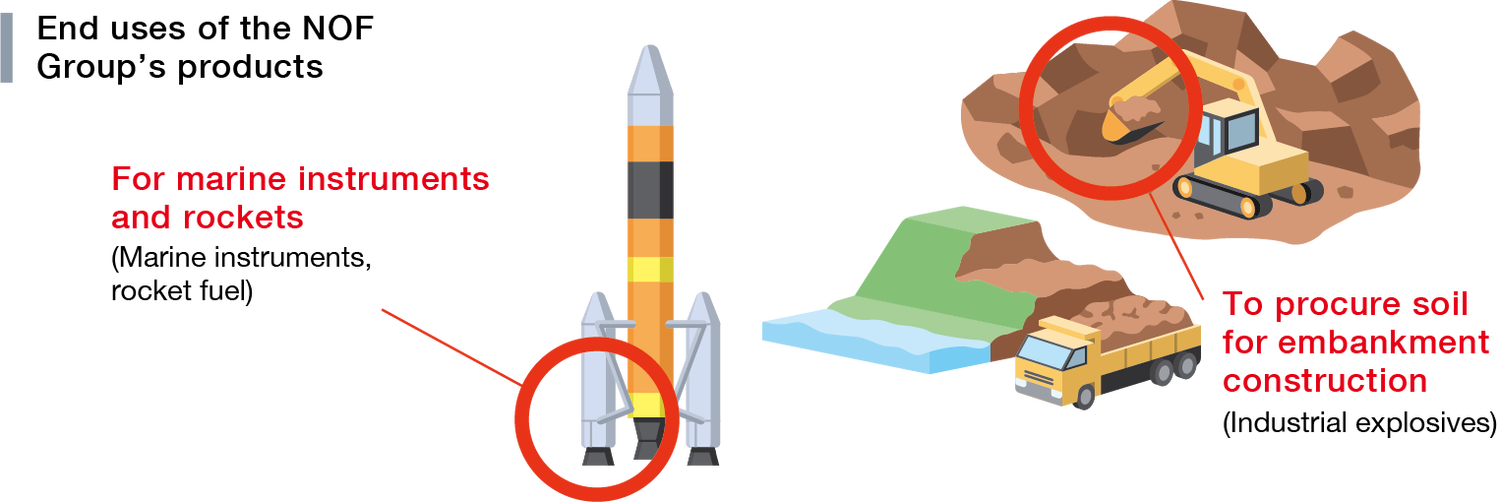

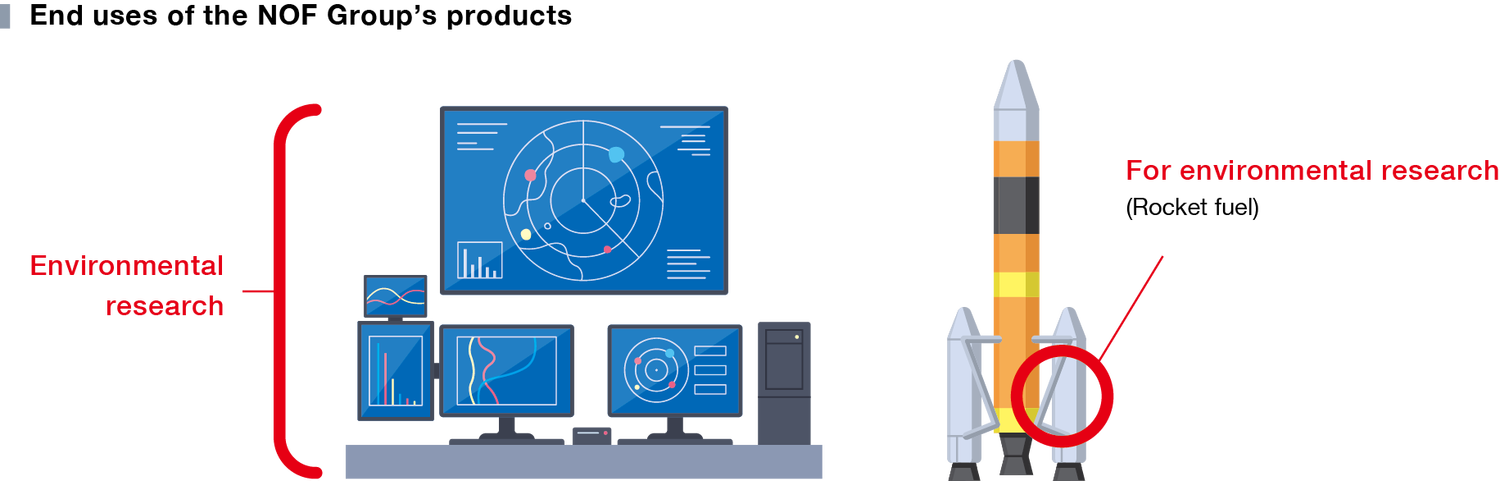

Environmental information / Disaster prevention and mitigation products

【Explosives & Propulsion business】Market scale:Small

As climate change progresses, the need to survey the entire world, including seawater temperatures, may increase, and the amount of marine instruments, rocket launches, etc., for research may increase. In addition, there may be increased applications for temperature indicator materials (labels, stickers, etc.) for temperature control that change color when a specific temperature is reached. Furthermore, with the increased risk of storm surges and other such conditions, there may be an increase in embankment construction using industrial explosives involving procurement of rocks and soil from mountainous areas.

Products that Contribute to the Environment Related to Biodiversity Conservation

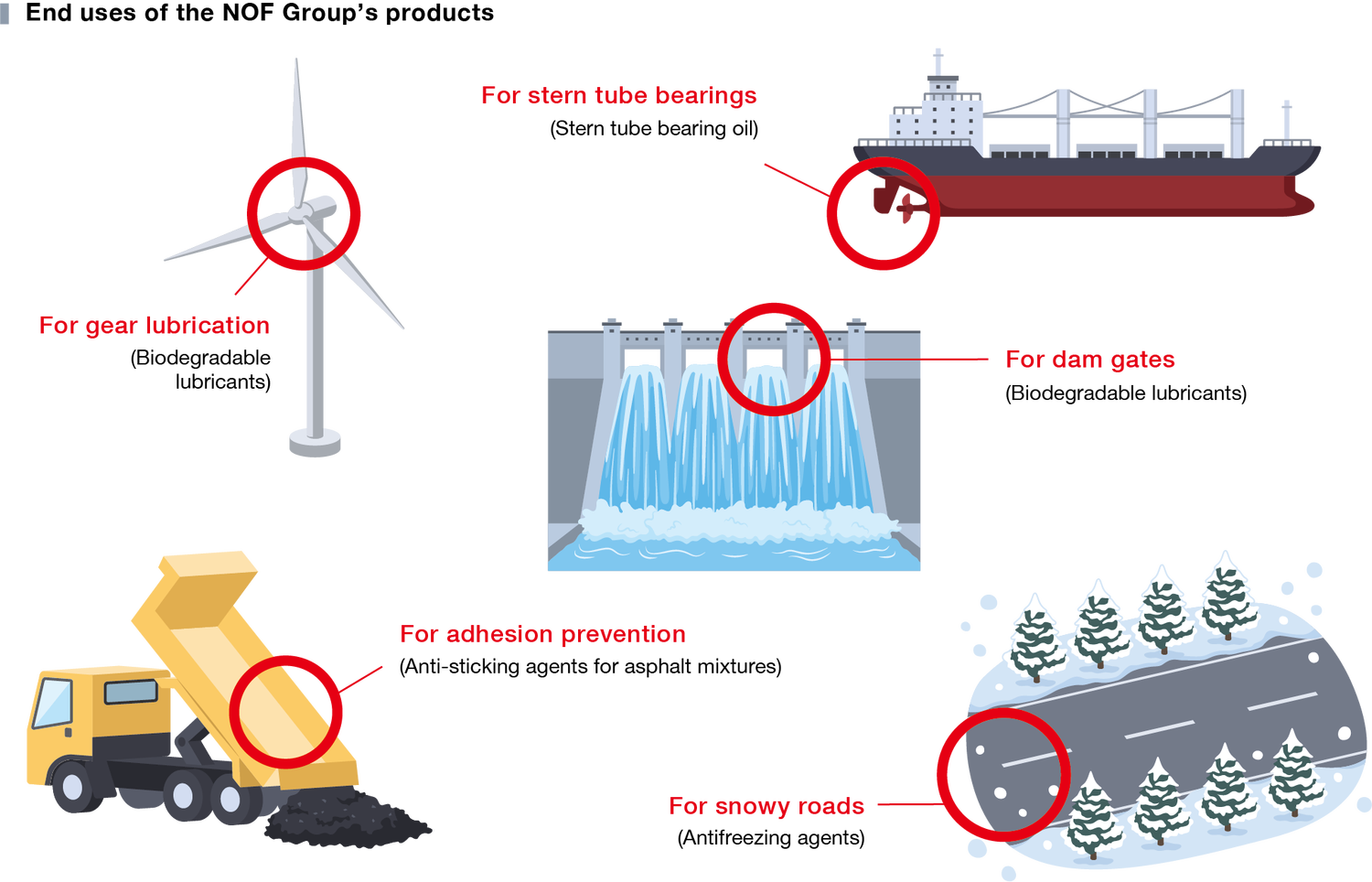

Prevention of soil and water pollution

【Functional Materials business / Explosives & Propulsion business】

Conventional lubricants used in construction equipment, dam gates, and wind power generation, as well as stern tube bearing oils and anti-sticking agents for asphalt mixtures used in road construction, can cause environmental pollution when released into nature. The NOF Group provides products that are highly biodegradable and thereby contributes to preventing soil and water pollution.

In addition, KAMAGU® is an eco-friendly antifreezing agent that does not cause salt damage to concrete sections of tunnels, bridges, etc., and also has minimal impact on plants. The AUTOKAMAGU® JET automatic antifreezing agent spraying device works using 100% natural energy (solar energy), and thus contributes to climate change mitigation.

Climate change mitigation

【Functional Materials business / Functional Foods business / Metal Coatings business】

It is believed that global warming will cause imbalances in ecosystems due to forest thinning, forest fires, and acidification of seawater, leading to an increased risk of extinction of plants and animals. We have various products related to climate change mitigation that also contribute to biodiversity.

See “Products that contribute to the environment in relation to climate change: Mitigation”

Protection of forests and animals

【Functional Materials business / Explosives & Propulsion business】

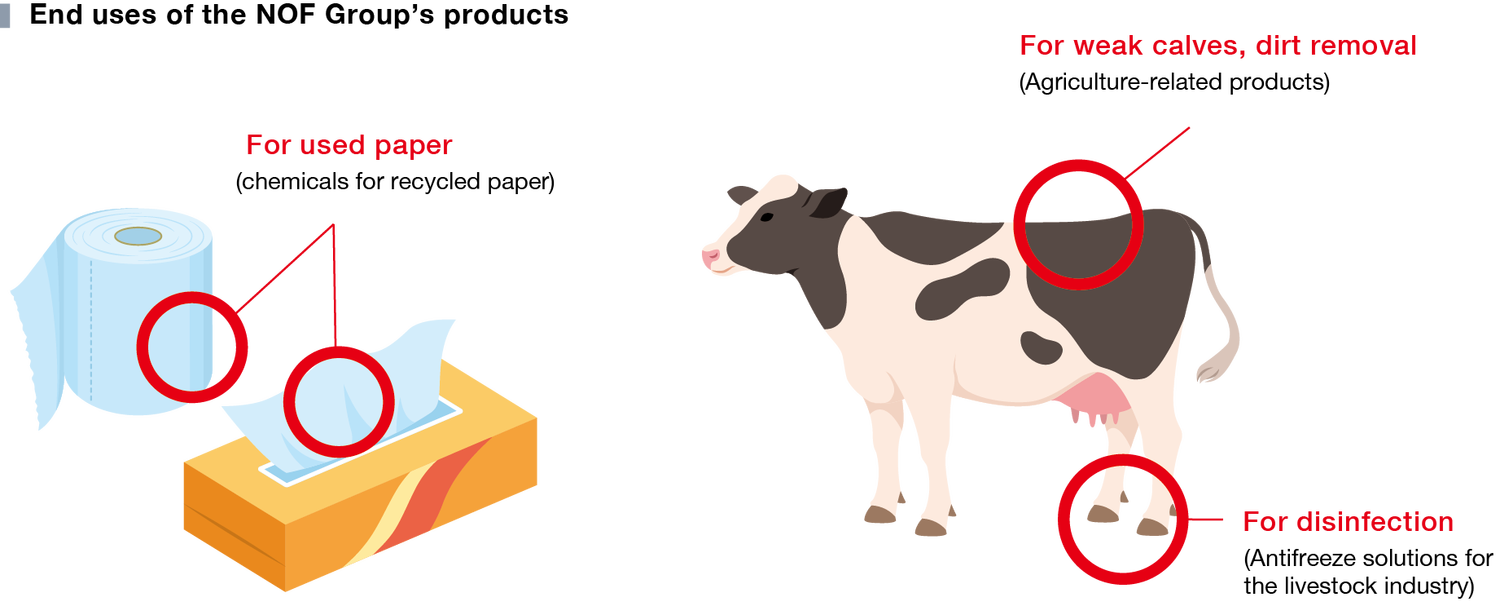

Recycled paper contributes not only to proper waste disposal but also to global environmental conservation such as protecting forest resources. The NOF Group contributes to forest protection with chemicals for recycled paper (pitch control agents, defiberization agents, etc.), which are indispensable for recycled paper.

In addition, Viva Frostir® is an antifreeze solution for the livestock industry that is gentle to animals and humans during winter disinfection. NEODRINK® maintains the physical strength of weak calves, and Za Yoroi-Otoshi helps reduce stress in cows by quickly removing dirt.

Environmental information

【Explosives & Propulsion business】

In addition to seawater and atmospheric observations, satellite surveys of vegetation and coastal zone changes and behavioral tracking of rare creatures are used as basic data for ecosystem conservation. Our marine equipment and rocket fuel also contribute to biodiversity.

Risk Management

Within the NOF Group, the Risk Management Committee comprehensively identifies various management risks surrounding its business, and conducts company-wide risk assessment on the level of impact and potential for occurrence of each risk item in order to identify key risks for monitoring. In disclosing information based on TCFD and TNFD recommendations, a working group consisting of members selected from the Risk Management Committee and the RC Committee plays a central role in identifying the risks related to climate change and natural capital among the various management risks surrounding our business, and conducts risk assessments to determine the degree to which the impact will change in the future. The analysis results are reported to the Sustainability Committee, and important decisions are made related to climate change and natural capital-related risk countermeasures.

Climate change and natural capital-related risk management organization diagram

Metrics and Targets

Metrics and targets related to climate change and natural capital

The NOF Group has set the reduction of greenhouse gas emissions as one of the goals of its Responsible Care (RC) activities, and has been working on various energy-saving measures. In view of the 2050 Carbon Neutral Declaration announced by the government in October 2020 and its new targets to reduce greenhouse gas emissions announced in April 2021, the NOF Group has decided to set new targets to reduce greenhouse gas emissions.

In addition, within the NOF Group’s materiality KPIs and CSR procurement, we have established climate change- and natural capital-related targets and are promoting initiatives to address risks and opportunities. With regard to the natural capital-related targets, we have begun collecting the metrics data shown below as part of the TNFD core global disclosure metrics and the chemical sector core disclosure metrics. Going forward, we will continue collect and expand the scope of metrics data while advancing efforts to reduce environmental impacts.

| Goals (KPIs) | Numerical targets | Target year | Details of major initiatives | |

|---|---|---|---|---|

| Contribute to the Environment / Energy field (NOF Group) |

Net sales of strategic products in the Environment / Energy field | 15% increase compared to FY2022 results |

2025 |

|

| Promotion of CSR-based procurement (NOF) |

Coverage rate of CSR questionnaire (based on value of purchases) |

85% or more | 2025 |

|

| Improvement requests via interviews to target suppliers in order to firmly establish CSR-based procurement (based on number of companies) |

85% or more | 2025 |

|

|

| Resilience enhancement (NOF Group) | BCP education and training hours | Total of 4,000 hours or more | Every year |

|

| Response to climate change |

CO₂ emissions (Domestic Group) |

40% reduction compared with FY2013 |

2030 |

|

| Carbon neutrality (NOF Group) |

Aim for achievement |

2050 | ||

| Chemical safety | Emissions of substances subject to PRTR Act after revision in FY2021 (Domestic Group) |

under 170 tons/year |

Every year |

|

| Metric no.* | Driver of nature change | Indicator | Metric | Reporting scope | 2024 results |

|---|---|---|---|---|---|

| - | Climate change | GHG emissions | Scope 1+2/Scope 3 | Sustainability Report:P.140 | |

| C1.0 | Land/freshwater/ocean-use change | Total spatial footprint | Total surface area controlled/managed by the organization | See “102nd Annual Securities Report” | |

| Total disturbed area | NOF Group | 0 thousand ㎡ | |||

| Total rehabilitated/restored area | NOF Group | 0 thousand ㎡ | |||

| C1.1 | Extent of land/freshwater/ ocean-use change |

Extent of land/freshwater/marine ecosystem use change | NOF Group | 0 thousand ㎡ | |

| Extent of land/freshwater/marine ecosystem conserved or restored | NOF Group | 0 thousand ㎡ | |||

| Extent of land/freshwater/marine ecosystem that is sustainably managed | Sustainability Report:P.148 | ||||

| C2.0 | Pollution/pollution removal | Total amount of pollutants released to soil split by type | PRTR Act-controlled substances | ||

| C2.1 | Wastewater discharged | Volume of water discharged | Sustainability Report:P.148-149,153 | ||

| BOD, COD, suspended solids PRTR Act-controlled substances | |||||

| Temperature of water discharged | NOF Group (Regulated sites: Chidori Plant, Daishi Plant) |

25–32°C In accordance with Kawasaki City ordinance |

|||

| C2.2 |

Waste generation and disposal | Weight of waste (total) |

Sustainability Report:P.158 | ||

| Weight of waste (hazardous) | NOF Group | 7,395 tons | |||

| Weight of waste (non-hazardous) |

NOF Group | 141,248 tons | |||

| Weight of external disposal waste Final disposal quantity by landfill | Sustainability Report:P.158-159 | ||||

| Recycled amount | Sustainability Report:P.158-159 | ||||

| C2.3 | Plastic pollution | Weight plastic used | NOF | 2,648 tons | |

| C2.4 | Total amount of non-GHG air pollutants | NOx, SOx, particulate matter VOC Hazardous air pollutants PRTR Act-controlled substances |

Sustainability Report:P.151-153,156 | ||

| C3.0 | Resource use/ replenishment |

Water withdrawal and consumption from areas of water scarcity | Water withdrawal from areas of water scarcity |

NOF METAL COATINGS EUROPE N.V. PT.NOF MAS CHEMICAL INDUSTRIES |

453 thousand ㎥ (5.7% of the NOF Group total) |

| Water consumption from areas of water scarcity | 152 thousand ㎥ (8.1% of the NOF Group total) |

||||

| - | - | Revenue from pesticide use, by toxicity level | No revenue from pesticides | - | |

| - | - | Rate of change in PFAS production | No production or use of PFAS | - | |

| - | - | Compliance violations | Violations of environmental laws and regulations | Sustainability Report:P.164 |