NOF Group Sustainability

Message from the President

a future-focused approach

President and Chief Executive Officer

Koji Sawamura

Thank you very much for your interest in the Web site of the NOF Group.

With “contributing to humanity and society as a corporate group that creates new value through the power of chemistry, ‘from the biosphere to outer space’” as our Corporate Philosophy, the NOF Group is engaged in business operations in our three prioritized business fields of Life/Healthcare, Environment/Energy, and Electronics/IT through our original products and technologies.

Today, the world is facing numerous challenges, including environmental issues such as climate change as well as human rights issues. Working toward the realization of a sustainable society is an obligation that all companies must address. Confronting these challenges head-on, the NOF Group strives to achieve carbon neutrality and preserve natural capital, aims to reduce environmental impacts throughout the entire product life cycle, and continues tackling the creation of social value through provision of optimal solutions.

Our vision for achieving a sustainable society, NOF VISION 2030, reflects our goal of fully leveraging the NOF Group’s technological and creative capabilities to take a great leap forward as a global company. Under this vision, our 2025 Mid-term Management Plan starting in fiscal 2023 is positioned as the profit expansion stage (Stage II) while the subsequent 2028 Mid-term Management Plan is the business domain expansion stage (Stage III), outlining a long-term path for growth.

Drawing on my past experience in R&D and international operations, and based on my conviction that change is an opportunity for growth, I have resolutely taken on challenges in technological innovation and business transformation, addressing a wide range of challenges. To ensure the NOF Group’s sustainable growth, I am focusing all my efforts on management that unites the passion and creativity of every employee, fostering an approach that constantly embraces change.

We are committed to enhancing sustainable corporate value for our shareholders and investors, offering innovative products and services to our customers, and providing a rewarding workplace and opportunities for growth to our employees. Furthermore, by collaborating with local communities and partner companies, we will strive to grow alongside them and help realize a more prosperous future.

The NOF Group will continue its mission to contribute to people and society as a corporate group that creates new value across wide-ranging business domains, “from the biosphere to outer space.” To fulfill this mission, we will further strengthen our technological development foundation, enhance the specialization of our products and services, and improve quality management, thereby advancing as a corporate group with the spirit of a technology-driven venture company.By meeting the expectations of our stakeholders and continuing to take steady steps forward, we will continue to deliver true value to society.

I hope this report helps deepen your understanding of our vision and initiatives.

For a sustainable society

We aim to contribute to society by solving our customers' business issues

As a functional materials manufacturer that supplies original products to markets in Japan and overseas, the NOF Group has grown together with its customers by gaining a deep understanding of their business challenges and providing optimal solutions. We believe that by contributing to our customers’ success, we can help improve local communities and the global environment, and aim to realize a sustainable society.

Under NOF VISION 2030, we provide innovative solutions in our three prioritized business fields: Life/Healthcare, Environment/Energy, and Electronics/IT.

- In the Life/Healthcare field, we contribute to society as a whole by offering products and solutions that support people's health and well-being, including DDS materials for pharmaceuticals, health foods, and cosmetics materials.

- In the Environment/Energy field, we are developing products that support the shift to electric vehicles and the spread of renewable energy, as well as products with added functions such as energy-saving functions. These products support our customers’ business growth while also helping to reduce environmental impact and contributing to a sustainable energy supply.

- In the Electronics/IT field, we offer high-function products developed with proprietary technologies for electronic components and materials requiring miniaturization and low dielectric properties. Through this, we support the evolution of communication technologies and contribute to solving social issues such as remote medical care and optimized energy management.

Our aim via these efforts is to improve health and well-being, protect the environment, and ensure the efficient use of resources, thereby building a sustainable future.

We will continue to work as a united Group to solve customers’ problems and create new value as a functional materials manufacturer. We will also strive to enhance our competitiveness in global markets and become a company trusted by all stakeholders.

Reflection on FY2024

Business performance reached a record high

The NOF Group achieved record highs in all consolidated indicators: net sales, operating income, ordinary income, and net income. Net sales increased ¥16.1 billion year-on-year to reach ¥238.3 billion, operating income increased ¥3.2 billion to ¥45.3 billion, ordinary income increased ¥1.0 billion to ¥46.6 billion, and net income reached ¥36.5 billion. This achievement is the result of steady implementation of measures in each business segment and appropriate responses to market conditions, as well as the support of all our stakeholders. We express our deepest gratitude.

In the Functional Chemicals business, strong demand for cosmetics-related products and special anti-corrosion coatings drove performance, resulting in net sales of ¥150.9 billion (a ¥17.4 billion increase year-on-year) and operating income of ¥29.7 billion (a ¥7.8 billion increase). While cosmetics-related products and special anti-corrosion coatings made significant contributions, weak demand for fatty acid derivatives in the Chinese market remained a challenge.

In the Pharmaceuticals, Medical, and Health business, the main factor behind the decline in results was temporary cooling of demand for raw materials for DDS drug formulations, due to inventory adjustments by some customers. As a result, net sales were ¥48.0 billion (a ¥6.0 billion year-on-year decrease), and operating income was ¥15.6 billion (a ¥4.9 billion decrease).

In the Explosives & Propulsion business, increased demand for defense products and space rocket products contributed to results, with net sales of ¥38.7 billion (a ¥4.6 billion year-on-year increase) and operating income of ¥3.1 billion (a ¥0.5 billion increase). In particular, the expansion in demand for defense products was the main driver of the profit increase.

Fiscal 2024 was a year in which we steadily expanded growth areas in each segment, while also revealing some challenges. Nevertheless, as a whole, we were able to achieve growth by leveraging the strengths of the Group.

Forecast of business results for fiscal 2025

The business results forecast for fiscal 2025 projects net sales of ¥252.0 billion, operating income of ¥46.0 billion, ordinary income of ¥47.9 billion, and net income of ¥36.8 billion—all expected to reach record highs. Under the 2025 Mid-term Management Plan, the operating income target for the final year (fiscal 2025) was set at ¥46.0 billion, and we will powerfully advance the implementation of measures across each business segment to achieve this target.

Furthermore, while the impact of U.S. tariff policy is not included in the forecast due to its uncertainty, there remains a possibility that our business may be directly or indirectly affected. We will closely monitor developments in tariff policy.

Growth strategies for our three segments

Functional Chemicals business

The NOF Group’s Functional Chemicals business continues to achieve steady growth, centered on cosmetics-related products and automobile-related products. For fiscal 2025, we anticipate a year-on-year increase in operating income of ¥400 million, exceeding the target set in the 2025 Mid-term Management Plan. In particular, cosmetics-related business is a major driver of overall business growth.

Cosmetics-related business:

Business growth through a cycle-based strategy

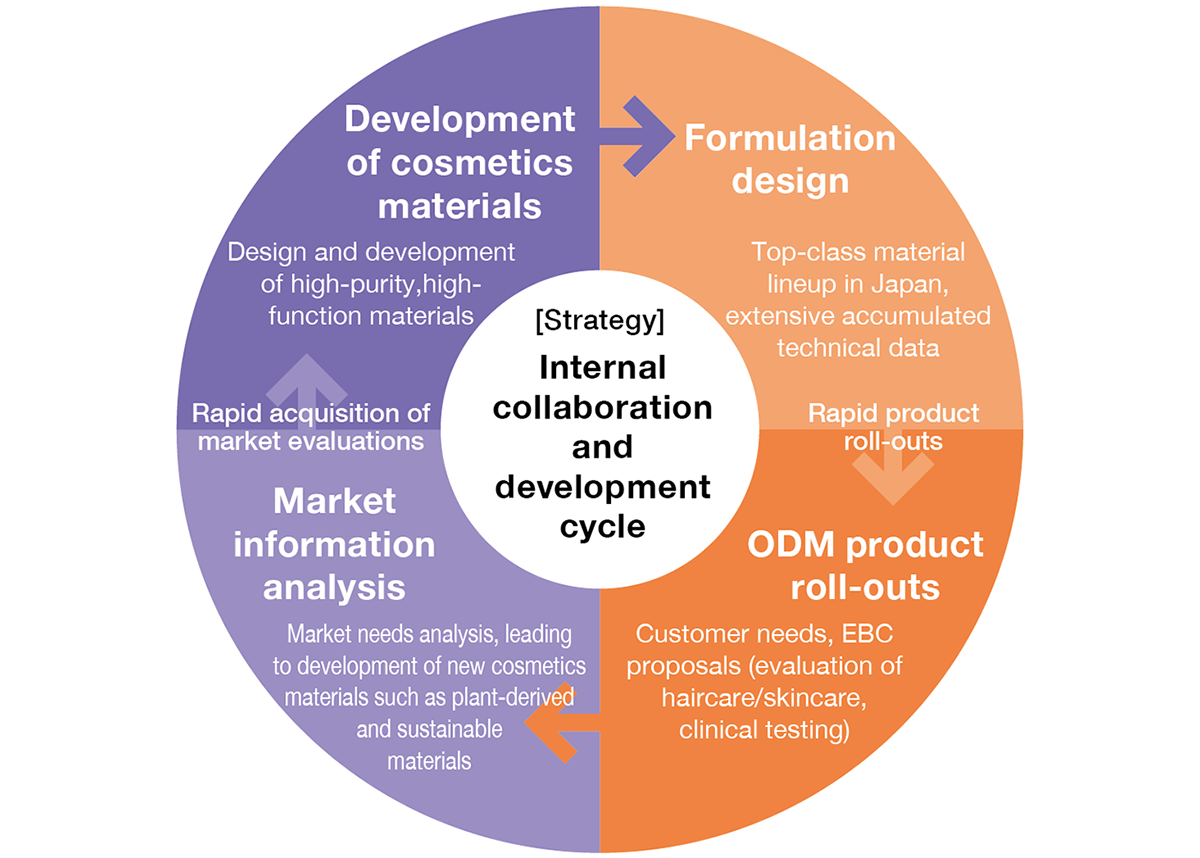

In the cosmetics-related business, we maintain our competitive edge by swiftly cycling through material development, formulation design, original design manufacturer (ODM) product development, and new material development based on market information. This “cycle-based strategy” is made possible through strong internal collaboration.

Cosmetics materials continue to perform well across skincare, haircare, and body care products, bolstered by our broad product lineup and development capabilities attuned to market trends. In ODM products, our anti-aging and beauty haircare products have been highly evaluated in the market due to our flexible proposals tailored to customer needs. Going forward, we are aiming for market expansion both in Japan and overseas by developing cosmetics materials that utilize environmentally friendly raw materials such as plant-derived materials, and by proposing ODM products including cosmetics with high natural origin indexes and high-function UV protection products. To this end, we implemented a facility investment for our Aichi Works.

Automobile-related products:

Flexible response to market changes

Demand is increasing for special anti-corrosion coatings for automobiles, driven by recovery from the decline in demand during the COVID-19 pandemic and by the tailwind of expanding electric vehicle (EV) production and subsidy programs in the Chinese market. We will continue to promote the development and sales expansion of products for EVs, while also positioning the construction and infrastructure fields as key areas following the automobile field, and working to cultivate these markets. In addition, for automobile-related products, we are expanding into the market for noise reduction agents that are well-suited for EVs as resin additives, high-durability anti-fog agents for various lamp units, and sealing materials.

Development of next-generation products and business expansion

In the Functional Chemicals business, with a view to responding to sustainability, tighter regulations, and next-generation technologies, we are focusing on the development of the following new products:

- PFAS-free monomers and polymers for water/oil-repellent agents

- Biodegradable lubricants with high viscosity optimized for ship-based use

- Environmentally conscious chemicals and manufacturing processes integrating technologies such as bio-manufacturing through industry-academia-government collaboration

- Raw material monomers for polyimide-related materials used in semiconductors

These products and technologies are expected to contribute to the realization of a sustainable society and become key pillars supporting our expansion into new business domains.

Outlook for the future

Our Functional Chemicals business will accelerate growth not only through strengthening existing businesses centered on cosmetics materials, ODM products, and automotive-related products, but also through new product development and overseas expansion. Through flexible market responsiveness and the provision of innovative solutions, we will pioneer a sustainable future and further enhance our competitiveness in the global market.

Pharmaceuticals, Medical, and Health business

The NOF Group’s Pharmaceuticals, Medical, and Health business contributes to the advancement of pharmaceuticals and medicine, as well as to the improvement of people’s health, by providing innovative solutions centered on raw materials for DDS drug formulations.

In particular, our activated PEG—which we have expanded since its commercialization in 2001 by leveraging our manufacturing technologies for fatty acids, phospholipids, and PEG derivatives—holds the top global market share thanks to its extensive adoption in the peptide and protein drug markets, which are growing at a rate of 9%. We are focusing on providing customized solutions tailored to customer needs and on meeting the demand for PEGylated pharmaceutical biosimilars.

Furthermore, in the nucleic acid and gene therapy drug market which has seen considerable growth in recent years, we are focusing on cultivating new customers by proposing LNP formulations. This effort is bolstered by our proprietary ionizable “SS lipids,” developed to enhance degradability in the body, and by our proven track record in PEG lipids for COVID-19 vaccines.

Raw materials for DDS drug formulations:

Strengthening production systems and new product

development in preparation for future growth in demand

In our forecast for fiscal 2025, despite being affected by delays in clinical development by biotech ventures, we expect operating income for the overall Pharmaceuticals, Medical, and Health business to increase by ¥300 million year-on-year, supported by demand recovery from existing customers and progress in new pipeline drugs under development. In particular, the LS Aichi Plant, scheduled to begin operation in October 2025, will be the key to further accelerate growth.

In fiscal 2023, strong demand related to late-stage clinical trials and product launches drove the business. However, fiscal 2024 saw demand plateau due to inventory adjustments by some customers and delays in clinical development by biotech ventures. Nonetheless, from fiscal 2025 onward, growth is expected to be supported by increasing demand from some customers and by new projects, including more than five pipeline drugs currently in the late clinical trial stage.

We aim to achieve growth in line with the biopharmaceutical market growth rate (about 10%) by promoting the following measures.

- Expansion of market share by capturing demand from new pipelines and biosimilars

- Strengthened acquisition of early-stage development projects and focus on themes with high potential to grow into major pipelines

Through these efforts, we will further solidify our medium- to long-term growth foundation.

To prepare for future demand increases, the LS Aichi Plant is scheduled to begin commercial operation in fiscal 2025. This new plant will serve as a manufacturing facility for commercialized products (activated PEG). In addition, through proactive facility investment and process efficiency improvements in anticipation of rising demand, we will further enhance the competitiveness of the business.

In the areas of R&D and new business development that we have prioritized through now, we are both providing rapid, customized responses to customer needs for DDS materials, as well as advancing proposals for solutions for nucleic acid drug materials using Materials Informatics. We are also continuing the development of new products targeting modalities with anticipated high growth, and actively pursuing new technology development through expanded collaboration with external research institutions.

LS Aichi Plant

Edible oils, functional food materials, and healthcare food products:

Promoting business structure transformation

We are advancing the transformation of our business structure to shift from the conventional foods business to the functional foods business. In our processed oils and fats business, we are promoting the development and sales expansion of functional food materials that help maintain aspects such as the softness of bread and confectionery, as well as the texture and volume of foods, along with functional food materials that make effective use of unutilized resources. In our health-related business, we are focusing on the development of health-related products based on our proprietary new materials and technologies.

Outlook for the future

In the U.S. market, despite delays in clinical development by biotech ventures continue, we anticipate the long-term growth of functional lipids. We aim for sustainable growth by responding flexibly to such market changes and providing innovative solutions.

The Pharmaceuticals, Medical, and Health business is moving forward with strategies to steadily capture demand growth and market expansion from 2025 onward, while overcoming short-term changes.

Explosives & Propulsion business

The NOF Group’s Explosives & Propulsion business continues to grow steadily in response to increasing demand for defense products and space rocket products. Operating income for fiscal 2025 is expected to increase by ¥400 million year-on-year, contributing to Japan’s defense capability development and space development efforts.

Responding to expanding demand

In the field of defense products, the NOF Group is expected to expand its production capacity as part of the Japanese government’s efforts for accelerated deployment of defense equipment incorporating advanced technologies, and we are currently considering a facility investment plan totaling about ¥100.0 billion.

In addition, information from satellites, which is indispensable to our daily lives, is increasingly in demand across a wide range of industries, including advancements in telecommunications and the commercialization of autonomous driving. As a result, demand for our solid propellants used in space rockets is also expected to increase. We will respond to such demand by leveraging our advanced technological capabilities and establishing an efficient production system.

Outlook for the future

The Explosives & Propulsion business supplies industrial explosives, defense products, and space rocket products. Much of this is on the basis of the Japanese government’s national policy. We are working to strengthen our facilities and improve productivity to ensure a stable supply of products, while also focusing on the introduction of environmentally conscious facilities and product manufacturing, thereby contributing to the enhancement of corporate value.

From strategic investment in the 2025 Mid-term Management Plan

to a leap forward in 2030

With regard to strategic investment, we are actively investing in facilities, R&D, and human capital by utilizing the ¥70.0 billion investment framework established in the 2025 Mid-term Management Plan to realize NOF VISION 2030.

Facility investment

The NOF Group is actively carrying out facility investment during the 2025 Mid-term Management Plan period to support sustainable growth. Planned facility investment for this period is expected to reach ¥67.4 billion, about three times the amount of the 2022 Mid-term Management Plan. The investment plan can be broadly categorized into three areas: expanding profit, productivity improvement, and environmental response.

In terms of expanding profit, the new cosmetic ODM line has begun operation as planned, and the new plant for raw materials for DDS drug formu-lations, which is currently under construction, has entered the preparation stage for operation. In addition, in response to requests from the Japanese government and prime contractors, we are enhancing the production capacity of facilities for accelerated deployment of defense equipment incorporating advanced technologies. We will continue to steadily pursue facility investment aimed at strengthening manufacturing capabilities in growth fields while monitoring changes in the market environment and anticipating market needs.

For productivity improvement, we are working toward the realization of smart factories, including the introduction of digital transformation (DX)-related technologies, through initiatives such as strengthening network infrastructure, promoting automation and labor saving, and improving operational efficiency by expanding the use of data in production and sales. Furthermore, in the area of environmental response, we are strengthening initiatives that contribute to CO₂ emissions reduction, including compliance with fluorocarbon regulations, the introduction of energy-saving manufacturing facilities, and a shift to energy sources with a low environmental impact.

Through this facility investment, the NOF Group aims to flexibly respond to environmental changes, contribute to the realization of a sustainable society, and further enhance the competitiveness of the overall business.

R&D

NOF and the AIST Group have established the NOF-AIST Smart Green Chemicals Collaborative Research Laboratory. At this collaborative research laboratory, we aim to integrate NOF’s and the AIST Group’s fundamental technologies and expertise to develop environmentally friendly chemical manufacturing processes and create smart green chemicals that contribute to decarbonization and prosperous lives. Through these efforts, we aim to continuously deliver new value to society through the power of chemistry, while contributing to the realization and development of a sustainable chemical industry.

In our initiatives to enhance the efficiency of R&D, at the Life Science Research Laboratory we are promoting the use of Materials Informatics through efforts such as applying data analysis to the optimal formulation design of lipid nanoparticles (LNP) for gene therapy and nucleic acid drugs.

R&D expenses in fiscal 2024 totaled ¥7.9 billion for the entire Group. In fiscal 2025, we plan to invest ¥8.8 billion in R&D across the Group, and will continue to advance R&D to expand our business domains.

Human capital investment

As part of our measures to foster a diverse workforce with high employee engagement, we are working to encourage employees’ autonomous growth and create a comfortable workingenvironment. We are also advancing human capital investment aimed at securing and developing talent, including promoting the development of DX human resources and enhancing support for business activities overseas.

Beginning in fiscal 2025, with the aims of incentivizing employees to contribute to medium- to long-term corporate value enhancement as well as raising awareness of participation in stock price-conscious management, we will grant a special incentive payment equivalent to 20 shares of company stock annually to employees who are members of the Employee Shareholding Association. Through the introduction of this scheme, we aim to promote value-sharing between our shareholders and employees and strive to enhance corporate value even further.

Capital policy

With regard to cross-shareholdings, we are proceeding with sales based on our target of reducing the ratio of cross-shareholding to consolidated net assets to 15% or less during the 2025 Mid-term Management Plan period. As of the end of March 2025, the ratio fell by 3.9 points from the previous fiscal year to 14.8%. We will continue to reduce cross-shareholdings beyond fiscal 2025 as well.

For dividends, in fiscal 2024, we paid an interim dividend of ¥21 and a year-end dividend of ¥24, resulting in an annual dividend of ¥45 and a dividend payout ratio of 29.2%. In fiscal 2025, we forecast an interim dividend of ¥24 and a year-end dividend of ¥24, for a projected ¥3 year-on-year increase of the annual dividend to ¥48 as well as a projected dividend payout ratio of 30.5%. Since fiscal 2009, we have consistently increased dividends. Going forward, based on maintaining stable dividends, we aim to achieve progressive dividends over the medium to long term. We recognize the return of profits to shareholders as an important issue for management. While our target total return ratio during the 2025 Mid-term Management Plan period is set at around 50%, considering factors such as the level of net cash at the end of fiscal 2024, future free cash flow forecasts, and ROE, we implemented a share repurchase of ¥20.0 billion in fiscal 2024. Going forward, we will continue to consider flexible repurchases of treasury shares in line with the target level set for the 2025 Mid-term Management Plan with the aim of improving capital efficiency.

In the next Mid-term Management Plan, our first priority will be making investments for business growth. However, we will also formulate a cash allocation plan and continue working to improve capital efficiency.

Looking ahead to 2030

For the NOF Group, fiscal 2025 is an extremely important year that represents not only the culmination of the 2025 Mid-term Management Plan but also a bridge to the 2028 Mid-term Management Plan. We forecast consolidated operating income for fiscal 2025 to be¥46.0 billion. To achieve further growth and expand earnings, we will deepen our initiatives thus far while responding flexibly to a changing environment and establishing new foundations for growth. We will also advance the strengthening of the solutions business, which serves as a growth driver, and accelerate the planning and execution of new investment initiatives, including M&A for business model transformation, in preparation for the 2028 Mid-term Management Plan, which marks our business domain expansion stage.

Meanwhile, the foundation of the NOF Group’s business management lies in a thorough commitment to safety and compliance. By deepening our Responsible Care activities and instilling the NOF Group Corporate Code of Ethics, we aim to ensure stable business management alongside highly engaged employees in a safe and open workplace environment.

Going forward, the NOF Group will continue to pursue its value of “Challenge” in new areas in the spirit of a venture company, while also upholding strong ethical standards and pursuing value creation that meets the expectations of society guided by our values of “Fairness” and “Harmony.”